Last week Monday, the National Institute for Legislative and Democratic Studies (NILDS), provided a platform for dissecting revenue generation and expenditure management in Nigeria for better budget implementation. TAIYE ODEWALE reports

The discourse

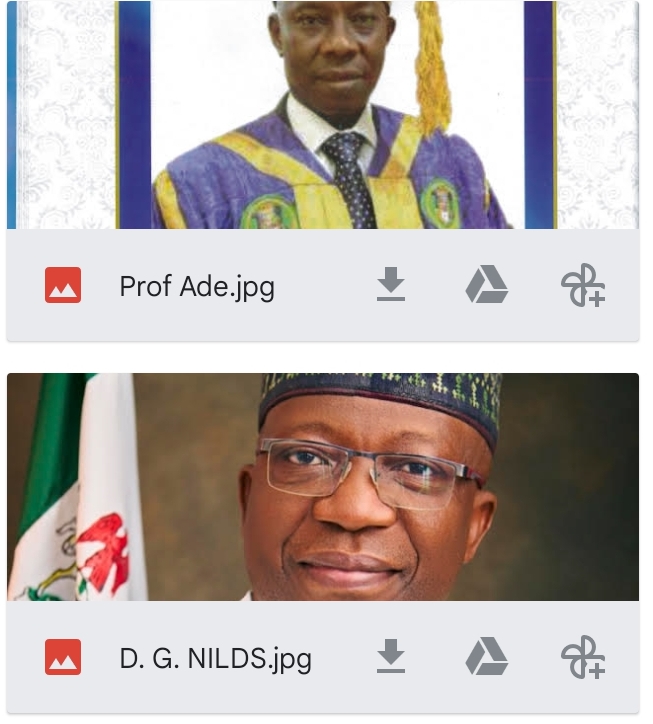

The discourse on improving public revenue generation and expenditure management in Nigeria was provided by the National Institute for Legislative and Democratic Studies (NILDS), last week Monday in Abuja as a convocation lecture delivered by Professor Adeola Adenikinju of the Department of Economics, University of Ibadan.

Professor Adenikinju in the convocation lecture the 7th in the series for graduands of Post – Graduate Programmes run by the Institute in collaboration with the University of Benin (UNIBEN), itemised series of issues for consideration by government for improved revenue generation and expenditure management.

According to him, revenue and expenditure were the two major components of any budgetary proposals which required correlation in form of demand and supply.

The don posited that revenue as projected income, must measure up in terms of generation, to projected expenditure for impactful budget implementation.

Need for balanced budgeting

Professor Adenikinju explained further that revenue generation as life wire of budget implementation , need to be taken seriously by government at all levels in the country.

He said: “Government budget can either be surplus; in which the income of government is greater than expenditure of the fiscal year, balanced; in which the government revenue is equal to its expenditure, or deficit; where expenditure of the government is greater than its revenue.

“For Nigeria, over the years, it has been deficit budgeting, financed or implemented by borrowed monies which is not healthy for the country economically, hence the need for improved revenue generation.

“Strategies that can be adopted for improved revenue generation in the country are (i), boosting oil revenue by developing the sector on horizontal diversification template into oil and gas – based industries which would save the country from the shame of the same volume of oil per day over the last 50 years. It was 1.2million barrels per day in 1970 and still around or below the figure 53 years after.

“(ii) Diversification of revenue sources is also very key for the improved revenue generation. For instance, the agriculture sector contribution to the country’s income in 2022 was 25.58%, the service sector contributed 56.3% to the aggregate GDP. These statistics indicated that the non – oil sector can contribute more, if given the needed attention by government at all levels.

“Other required measures for improved revenue generation in the country are: strengthening tax administration enforcement, enhancing revenue collection mechanism, promoting transparency and accountability in revenue management, improving data collection and analysis for informed decision making and commitment to the implementation of Petroleum Industry Act (PIA) cum fuel subsidy removal”.

Expenditure management

The university don during the lecture posited further that expenditure management is also key on effective budget implementation and service delivery by government. According to him, accountability and transparency in public spending is very important to curb wastefulness and corruption, just as prioritisation on projects executions is also important.

“There must be strict efforts to ensure fiscal discipline on the part of the government by focusing expenditure on capital expenses that yield long- term benefits to Nigerians and Nigeria”, he stressed.

Akpabio’s concurrence

In his speech at the convocation ceremony, the President of the Senate, Godswill Akpabio, concurred to submissions made by Professor Adenikinju on the need for improved revenue generation in the country for better budget financing and implementation.

Akpabio whose speech was read by the Chairman, Senate Committee on Finance, Senator Mohammad Sani Musa (APC Niger East), said: “To NILDS and UNIBEN, I identify strongly with the Convocation Lecture: Improving Revenue Generation and Expenditure Management: Issues for Consideration.

“Revenue generation and expenditure management are the twin wings which drive development. As the governor of Akwa Ibom state, I left a trail of development which led to the good people of the state describing what they saw as uncommon transformation.

“To increase our revenue base, we must break the cycle of a mono-economy. Decades ago, Nigeria was the world’s largest producer of the following agricultural products; cocoa, palm produce, groundnuts and others. We had groundnut pyramids in the north, the cocoa houses in the west, and palm plantations in the east. I believe that if we go back to these agricultural products and add them to our oil earnings, our revenue generation will be boosted.

“All the same we should know that if the Government spends more than its revenue, it is bad for our country. Which was one of the reasons the petroleum subsidy had to go.

“Spending more than its revenue leads Government to three choices; raising taxes, printing more money or borrowing from loan sources. None of these options is good for any country. So, we should not put ourselves in that tight corner.

“Thankfully, the Bola Tinubu government has shown a commitment to increasing our revenue generation and effectively managing our expenditure.

“We in the National Assembly, in our oversight function, will also act to ensure that parastatals and agencies of government are in step with the expectation of the Tinubu Administration and Nigerians in expenditure management”.

Earlier in setting the tone for the lecture, the Director General of NILDS, Professor Abubakar Sulaiman in his speech said: “Over the years, we have strived to develop research-based and evidence-driven intellectual frameworks to aid navigation through the intricate landscapes of governance and legislation.

“The convocation of the graduands today is a manifestation of the success of our efforts at the institute thus far.

“This comprises graduands of Masters Degree in Legislative Studies, Master’s Degree in Law (LLM) Legislative Drafting, Master’s Degree in Parliamentary Administration, Master’s Degree in Elections and Party Politics, and Post Graduate Diploma in Elections and Political Party Management”.

Aptness of the lecture and of what impact?

As stated by many of the eminent personalities at the convocation lecture held at NILDS permanent site along the Airport Road, the lecture was apt but would it have any effects on revenue generation, expenditure management and development – driven budget implementation in the country ?

Answers for the above posers are in the womb of time as the country awaits budget presentations for 2024 fiscal year at all levels of government in weeks to come.