The idea of introducing a Treasury Single Account (TSA) in Nigeria was mulled by the administration of President Goodluck Ebele Jonathan in 2012. But it was aborted probably because it caused trepidation among bankers and other public money managers in the country.

However, it took off in September 2015 when former President Muhammadu Buhari took office. The TSA has inherent advantages which were explained by then Minister of finance, Mrs. Kemi Adeosun.

Prior to becoming finance minister, Mrs. Adeosun gained experience in implementing the TSA as commissioner for finance in Ogun state during the administration of Senator Ibikunle Amosun.

Mrs Adeosun told the Senate during her ministerial screening that over 500 Ogun state government accounts, some of them dormant, were placed under one TSA umbrella.

She said that action completely blocked leakages in government revenue and ensured availability of money for human capacity and infrastructure development in the state.

This shows that the TSA helped in reducing corruption by blocking financial loopholes, promoting transparency and enhancing accountability in the management of public finance.

Mrs Adeosun had highlighted more advantages of the TSA during workshops, retreats, meetings with state commissioners of finance and at media conferences on the subject.

She often explained to her audiences that the TSA facilitates effective reconciliation between the government accounts and cash flow statements from banks. In turn, this narrows the possibility of making mistakes in the reconciliation processes.

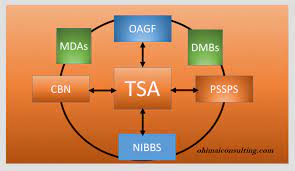

Other benefits derived from the TSA include consolidating government cash balances which gave the accountant general of the federation and the ministry of finance a real time overview of government cash flows; this improved budget control and monitoring.

More objectives and benefits of the TSA were listed in a February 2016 guidelines issued by the Central Bank of Nigeria (CBN) for the implementation of the TSA by states.

The enthronement of a centralised, transparent and accountable revenue management; facilitating effective cash management; and ensuring cash availability at all times were among the key objectives.

It was also aimed at promoting efficient management of domestic borrowing at minimal cost and allow optimal investment of idle cash. The TSA was envisaged to establish an efficient disbursement and collection mechanism for Government funds and improve liquidity reserve.

The CBN further said in the guidelines that the TSA was designed to eliminate operational inefficiency and costs associated with maintaining multiple accounts in multiple financial institutions.

Indeed, multiple accounts were rampantly operated in multiple financial institutions by federal government ministries, departments and agencies. The federal government announced in February 2017 while marking the first anniversary of the TSA that 20,000 of such accounts were closed and the N5.24 trillion in them moved to the TSA.

In November 2017, President Buhari disclosed at the National Information Technology Development Agency (NITDA) e-Nigeria conference that the TSA and the Biometric Verification Number (BVN) had stopped the leakage of N24.7 billion public fund monthly.

Years after former President Jonathan proposed it and its beneficial implementation by the All Progressives Congress (APC) administration of Buhari, President Bola Ahmed Tinubu has apparently modified or terminated it via a circular from the federal ministry of finance.

The notification on December 28, 2023 directed all ministries, departments, and agencies fully funded by the federal government to henceforth remit 100 per cent of their revenues into a Sub-Recurrent Account, a sub-component of the Consolidated Revenue Fund (CRF).

The circular stated this was designed “to improve revenue generation, fiscal discipline, accountability and transparency.”

This directive has effectively ended the TSA as operated by the Buhari administration. Nigerians are waiting for the benefits of the modified or new TSA.

Salisu Na’inna Dambatta was director of information, Federal Ministry of Finance.