An economist, Marcel Okeke has listed insecurity, oil theft, and implementation of palliatives, fluctuation of Naira and the coup in Niger Republic as the major factors affecting the Nigerian economy.

Okeke made the observations in Lagos at the monthly forum organised by the Finance Correspondents Association of Nigeria (FICAN).

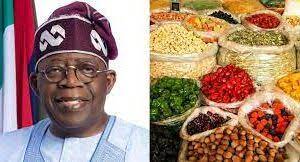

He warned that corruption could derail President Bola Ahmed Tinubu’s recently announced palliatives if not properly monitored and implemented, such that whatever ‘goodies’ that come the way of the state and local governments from the Centre would usually end up as ‘political patronage’ to be dispensed along party lines.

While discussing the 2023 half year economic outlook, Okeke, however, said that a critical look at the palliative measures show that they are a rehash of what the previous administration did.

He said that what the Nigerian economy badly needs at this time is a stimulus package rather than mere palliatives that are likely to end up in the wrong hands and pockets.

Palliatives, he said, (especially cash transfers) are unearned, unproductive ‘transfer payments’ that do not make for any economic progress.

He also commended the federal government on the Taiwo Oyedele led Committee on fiscal policy and tax reforms, saying it will bring new revenue-generation ideas for Nigeria.

He expressed optimism that the committee would work towards harmonising taxes to provide relief for companies and individuals.

Speaking on the theme; “The Impact of Post-Inauguration Fiscal, Monetary Policy Reforms on Nigeria’s Macroeconomic Environment”, he expressed the need to diversify the economy by developing sectors like agriculture and manufacturing as well as reducing dependence on oil.

Okeke, also noted that the depreciation of the Naira had led to significant foreign exchange losses for companies.

“It is a challenge because those losses are incurred because of the fluctuations of the Naira, or the unification of exchange rates.

The economist calls for quick government’s intervention to prevent further company collapses.

He cited the exit of GlaxoSmithKline (GSK) as an example, attributing its inability to repatriate revenues and dividends to foreign exchange shortages.

Okeke said that he hoped that GSK’s departure would not trigger a trend of other companies leaving as well.

He said, “It came to my knowledge that in a couple of five years, they have been unable to repatriate their revenues and dividends and that has been the fate of other major multinationals because of the shortage of foreign exchange in the

economy.

So, when you sum all those things, that will show you how soon this economy will be doing well or how far it will not be doing well.

“I pray that the exit of GSK will not turn into bandwagon for others to also leave.’’